by Lil Tuttle

The Trump Administration is pressing Congress to complete tax reform before the end of the year. What’s in the president’s reform package, and how would it affect you?

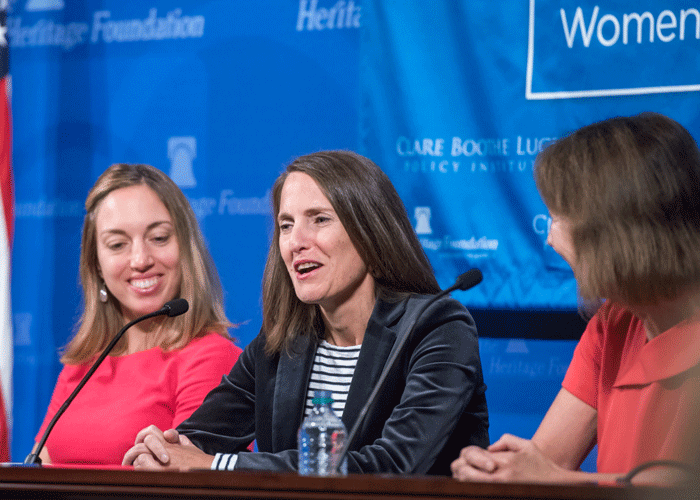

Three women – Romina Boccia, Veronique de Rugy, and Diana Furchtgott-Roth – discussed this, the federal budget system, and the federal debt at the Conservative Women’s Network luncheon in October.

The Federal Debt

Just as excessive individual debt negatively affects our personal spending choices and flexibility, excessive federal debt negatively affects our nation’s spending choices and flexibility. Liberals demand free college tuition and health care, but the hard reality is that there isn’t sufficient money to pay for current federal services, much less for new federal services.

The Federal Budget System

The debt problem is enabled by a federal budget process that is designed to increase automatically each year. It is not conducive to controlling or cutting spending.

The federal budget has two major parts:

- Autopilot Spending: 2/3 of the federal budget – covering programs such as Medicare, Medicaid, Social Security, welfare and income support, unemployment, and veterans programs – grow annually and automatically with no regular congressional review. Most of these programs have not been reformed in several decades.

- Discretionary Spending: 1/3 of the budget – covering national defense and domestic programs such as the Environmental Protection Agency, Department of Interior, Department of Education, etc. – must be reviewed and reauthorized by Congress yearly. Yet even when Congress completes its budgetary work, its Budget Resolution authorization does not have the force of law.

There are only two budgetary restraints on the federal government: the U.S. Debt Limit, which caps total spending by the federal government; and the Budget Control Act, which caps how much Congress can authorize for discretionary budget items.

Overcoming our Economic Woes Politically

There are only two ways to overcome the debt problem: either (a) reduce existing federal spending, or (b) increase economic growth while keeping spending the same so that spending as a proportion of our Gross Domestic Product (GDP) actually declines.

Neither is easy to do politically, since Washington finds it easier to delay fiscally sound policy reforms than to face them, or to forget principles in the quest to pass immediate legislation. The Debt Ceiling debate is one example: Any discussion of the Debt Ceiling results in “the sky is falling” hysterics, which shuts down any serious deliberation of fiscal policies that would yield better economic results over the long term.

Spur Economic Growth with Tax Code Reform

The easier path politically is to spur economic growth, and that likely will happen with Tax Code Reform.

The last time the tax code was overhauled by the U.S. Congress was the Tax Reform Act of 1986. It set a corporate tax rate of 35%, currently the highest among nations, but was, in 1986, similar to corporate tax rates of most other nations; and 7 individual tax rates ranging from 10% to 39.6%. It also created the Alternative Minimum Tax that was supposed to nab the super-earning taxpayers in the nation, but which, in the years since, squeezed middle and lower income taxpayers instead.

Key changes proposed by the Trump Administration are, according to Diana Furchtgott-Roth:

- Individual Taxpayers

- replace the 7 tax rates with only 3 tax rates: 12%, 25% and 35%;

- double the standard deduction (i.e., the amount you take off your income before calculating your tax owed) from $12,000 to $24,000 for most households;

- increase the child tax credit; and

- eliminate the Alternative Minimum Tax

- Corporate Taxpayers

- reduce the tax rate from 39% to 20% to compete with other nations’ lower corporate rates and bring business and industry back to the U.S. and increase jobs for U.S. workers.

If anything is likely to spur economic growth in the U.S., it is a major tax overhaul. Businesses respond to incentives, and the current incentive is to move businesses abroad and keep profits offshore and as far away from the U.S. Treasury as possible.

Diana provided this actual example of how foreign-owned corporations get a better tax deal than American-owned corporations. If American-based business Burger King (BK) brings $100 million in cash reserves earned world-wide to the U.S. to create new Burger King businesses, the U.S. Treasury Department takes a $39 million cut for taxes the moment BK’s money lands on U.S. turf. If, however, the Burger King corporation is acquired and owned by a Canadian-based corporation, the same $100 million investment can be brought into the U.S. tax free.

American-based corporations have about $2.7 trillion in world-wide profits sitting abroad. This major tax code reform would create the incentive for corporations to bring that money back to the U.S. to invest in American businesses and jobs.

Negotiations are underway in Washington on the Trump Administration’s tax reform proposal, and the president has called for passage before the end of the year. If Congress acts on this pro-growth policy reform, it could well be a boon for the nation’s – and your – economic advancement, income, and spending power.